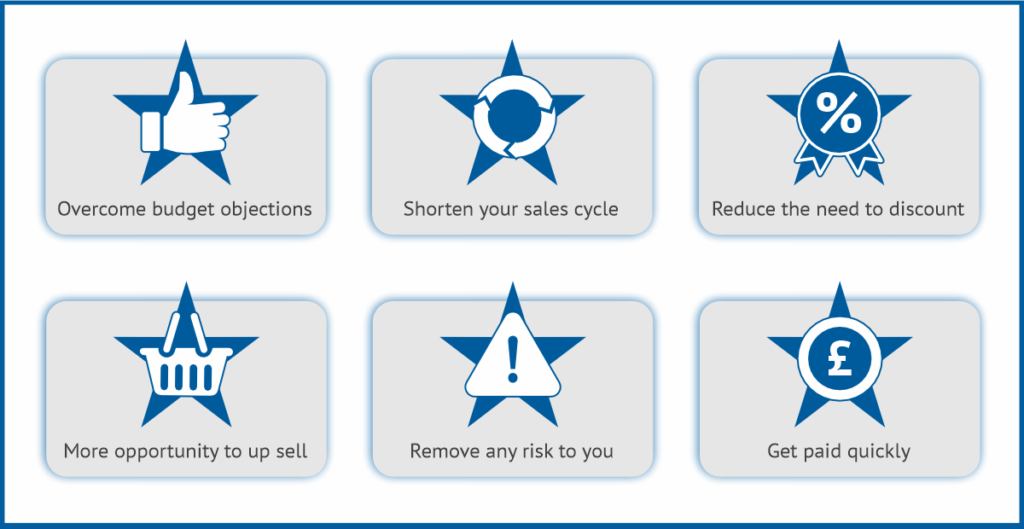

You know what’s really great about point-of-sale finance ? There are six distinct benefits that come with it:

Overcome budget objections:

Budget objections can be a real pain when you’re trying to close a deal. But with POS finance, it’s sorted! It breaks down the cost into manageable repayments, making it easier for your customers to say yes.

Shorten your sales cycle:

Long sales cycles can be a nuisance! But here’s the good news – when you offer POS finance, your solution becomes way more attractive, speeding up the whole process.

Reduce the need to discount:

Constantly giving discounts to seal the deal can hurt your profits. Well, guess what? With finance options, you won’t need to offer discounts because customers can pay in easy instalments.

Give more opportunity to up-sell:

Who doesn’t love up-selling? With affordable payment options, your customers can buy the equipment they need, without compromise and are more likely to add extra products and services to their package!

Remove any risk to you:

Waiting for full payment can be nerve-wracking, and sometimes customers don’t pay up. But with POS finance, you get paid upfront and in full by a lender. No more worrying!

Get you paid quickly:

Time is money, right? Once your customer chooses a finance option, you could be counting the cash in as little as 24 hours.

So, offering finance from Kennet is like a magic wand that helps you seal deals, boost profits, and get paid faster. It’s a win-win for everyone involved!